“Building wealth is like planting a tree—you start with a tiny seed, water it with discipline and patience, and hope squirrels (or unexpected expenses) don’t steal all your nuts along the way.”

Basic wealth building revolves around managing your income, expenses, and investments strategically over time to grow your net worth. Here are some key principles:

- Earn and Save:

Focus on increasing your income through skill development, career advancement, or side hustles.

Live below your means by budgeting and avoiding unnecessary expenses. Aim to save a portion of your income consistently.

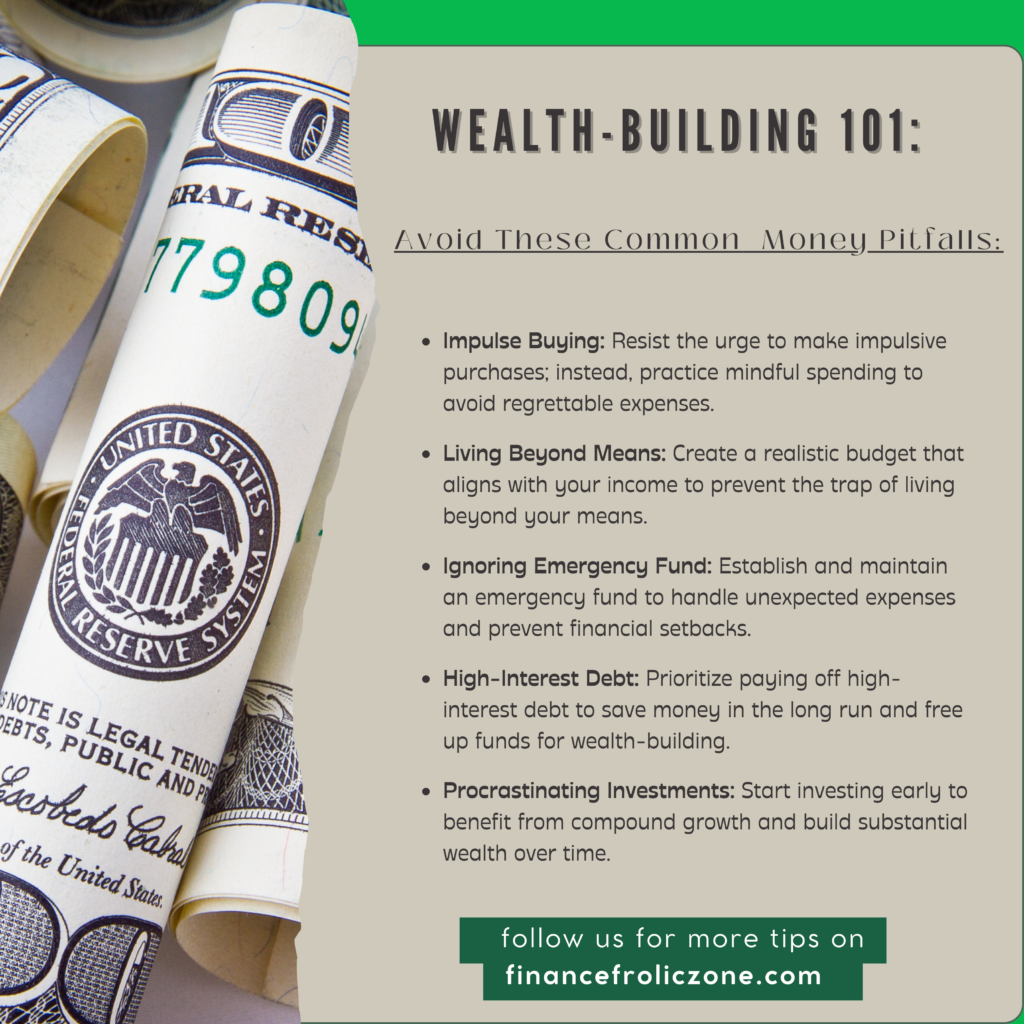

- Invest Wisely:

Put your money to work by investing in assets like stocks, bonds, real estate, or businesses that grow in value over time.

Take advantage of compound interest by starting early and investing regularly.

- Reduce Debt:

Pay off high-interest debt like credit cards quickly.

Use debt strategically, such as low-interest loans for investments or education that increase earning potential.

- Build an Emergency Fund:

Save 3–6 months’ worth of living expenses in an accessible account to handle unexpected situations without derailing your finances.

- Diversify Income Streams:

Develop multiple income sources (e.g., rental income, investments, freelancing) to reduce reliance on a single stream.

- Long-Term Thinking:

Focus on steady, sustainable growth rather than quick gains. Be patient and disciplined in your approach.

- Financial Education:

Continuously learn about personal finance, investments, and economic trends to make informed decisions.

Final Thought:

Wealth building is a marathon, not a sprint—start small, stay consistent, and adapt as needed.

– The Finance Frolic Zone

DISCLAIMER:

The information provided on The Finance Frolic Zone is for general informational and educational purposes only. While we strive to offer accurate, up-to-date, and helpful content, it should not be considered professional financial advice.

The Finance Frolic Zone may include affiliate links or advertisements. Clicking on these links may generate a commission for us, at no additional cost to you. These partnerships help us keep this blog running and deliver content to you for free. Rest assured, we only promote products or services we believe in.

By using the information on this blog, you acknowledge that you do so at your own risk. The Finance Frolic Zone and its authors are not liable for any financial losses or damages resulting from your decisions. Thank you for visiting The Finance Frolic Zone. We’re here to inspire and inform, but remember, your financial journey is uniquely yours. Make decisions that align with your goals and consult professionals when needed. For questions or concerns, feel free to reach out to us.

–The Finance Frolic Zone